The environment that gave rise to historic levels of capital investment in healthcare has changed dramatically causing a retrenching in the number of deals taking place across the industry. Record-low interest rates and high valuations over the past couple of years set the stage for private equity to pump billions of dollars into healthcare. But now inflation, fears of a recession, rising interest rates, record high valuation multiples, and the lingering impact of COVID-19 hang over the economy.

Beyond those broader economic woes, high-profile stumbles by several private equity-backed health startups, particularly in the digital space, have raised concerns across the industry about unfulfilled promises. And remarks by Deputy Attorney General Andrew Forman are also likely to raise red flags. He recently told the American Bar Association that the Department of Justice is looking at enhancing antitrust enforcement around private equity, including the home care, inpatient, outpatient, and pharmaceutical sectors.

Nonetheless, the shifting landscape creates opportunities for investors and healthcare firms alike to be more strategic in how they partner and access capital.

The Data Tells the Story

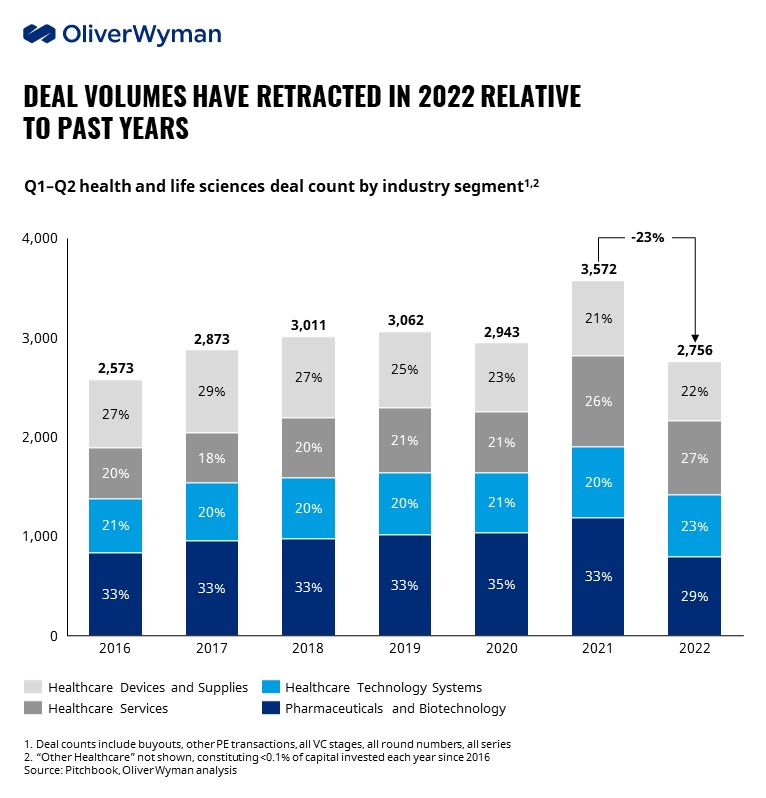

An Oliver Wyman analysis shows that the number of private capital-backed healthcare deals — including buyouts, all VC stages, and other funding — has fallen off significantly from the past few years, over the same period. Pharmaceuticals were particularly impacted, dropping from almost 1,200 deals in the first half of 2021 to ~800 deals in the first half of 2022, a 33% decline. That was a significant driver in the more than 20% decline in total deal volume through the first half of 2022.

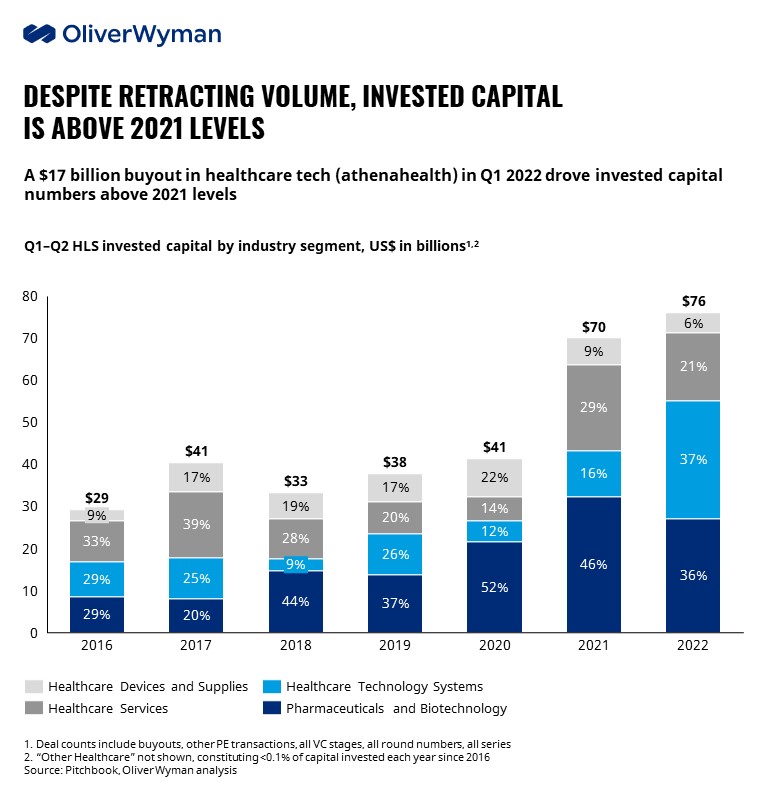

Despite the retraction in deal volume, the market has seen a higher level of capital invested in 2022 compared to prior periods. This can largely be attributed to the $17 billion buyout of healthtech company Athenahealth by Bain Capital and Hellman & Friedman in the first quarter of 2022. Through the first two quarters of 2022, pharmaceuticals, biotech, and healthtech have drawn significant interest. In fact, healthtech and pharmaceuticals accounted for over 70% of total capital invested over this period — coming in at 37% and 36%, respectively.

While 2021 saw historic levels of invested capital ($200 billion), 65% of capital invested came in the second half, headlined by the leveraged buyout of Medline, valued at $34 billion. The tremendous finish to 2021 explains how a retracting market by volume in 2022 could be outperforming a historic 2021 in total capital invested in the first half of the year.

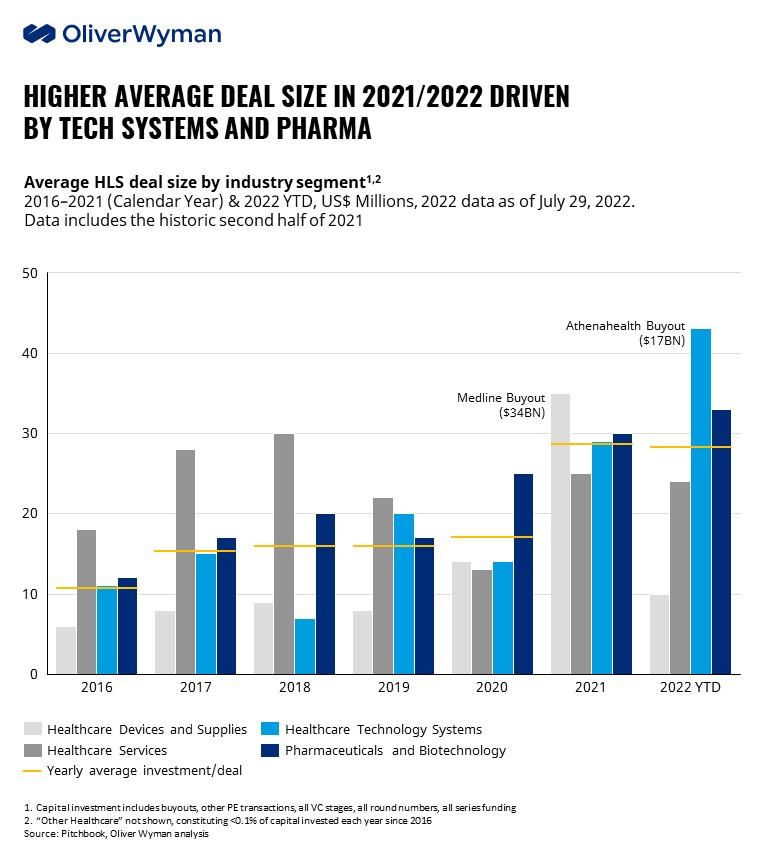

Not surprisingly, healthtech and pharma are also outpacing other sectors of the industry in average deal size, which stands in contrast to previous years when healthcare services were out in front.

New Approaches Taking Shape

As private equity takes a more cautious approach to investing in healthcare, we expect a few trends to playout for the remainder of 2022 and likely into 2023:

Insights in your inbox

SubscribeRigorous review: Investors will apply a more rigorous approach to maximizing valuations, especially after their stratospheric rise in 2021. That includes taking a closer look at operations, labor costs, supply chain limitations, and other factors that can impact a return on investment.

Rounds of funding: Startups need to moderate their funding expectations. The days of getting the bulk of funding in one or even two financing rounds are over. It’s more likely that it will take three or four rounds. Under that scenario, healthcare organizations must be more realistic about what they can deliver — and when — based on the financing in hand.

The need to partner: As we heard at the recent LSX Congress in Boston, startups and other innovators are looking to partner or collaborate with other firms to minimize risk and scale up quickly. This is especially true in healthtech where providers are growing weary of point solutions. By collaborating, startups can bring more wholistic platforms solutions to market, earlier than ever before.

Post-deal value creation: Given the rise of the level and size of private capital in the market, on-the-ground value creation driven by investors is now becoming the primary way to generate investor return. Investments in integrating and platforming, streamlining M&A, and strengthen operations is key for value generation for today’s investor.