Editor’s Note: This article is part of Oliver Wyman's ongoing series about the evolving novel coronavirus (COVID-19) pandemic.

In early March, as the United States began coming to grips with the potential impact of the COVID-19 pandemic, many healthcare providers put a pause on elective procedures and shifted their focus from normal operations to preparing to care for COVID-19 patients. At the same time, Americans began avoiding emergency rooms, physicians’ offices, and other healthcare settings, fearing the risk of infection. To date, in most of the country, the cost savings from this foregone care have generally exceeded the cost of treating COVID-19 patients. As a result, many health plans have seen their margins increase. Some health plans are responding by offering premium discounts, waiving cost-sharing for the treatment of COVID-19, and working to support providers, or a combination of the three. Health plans may be taking these actions, at least in part, to avoid having to pay medical loss ratio rebates under the Affordable Care Act.

At the same time, there is considerable uncertainty regarding the cost and utilization of healthcare services going forward as a result of at least the following factors:

- The potential for additional waves of COVID-19-related illness resulting costs

- Costs associated with treating the residual effects of patients recovering from COVID-19

- The timing, efficacy, and cost of any vaccine

- The cost of continued testing and who pays for the testing

- The impact of non-COVID-19 patients who delayed care and therefore present with more advanced disease

- The extent to which the care that has been foregone, say joint replacement surgeries, will ultimately return

In its 2Q 2020 earnings call, UnitedHealth Group’s Chief Financer Officer, John Rex, noted that, “At the lowest point in April, in-patient care, inclusive of COVID-19-related care, was about three-quarters of baseline. In June, this recovered to nearly 95 percent.” He further noted, “These national trends have continued thus far in July even as certain states are seeing short-term deferral of services where there are elevated levels of infection and hospitalization.”

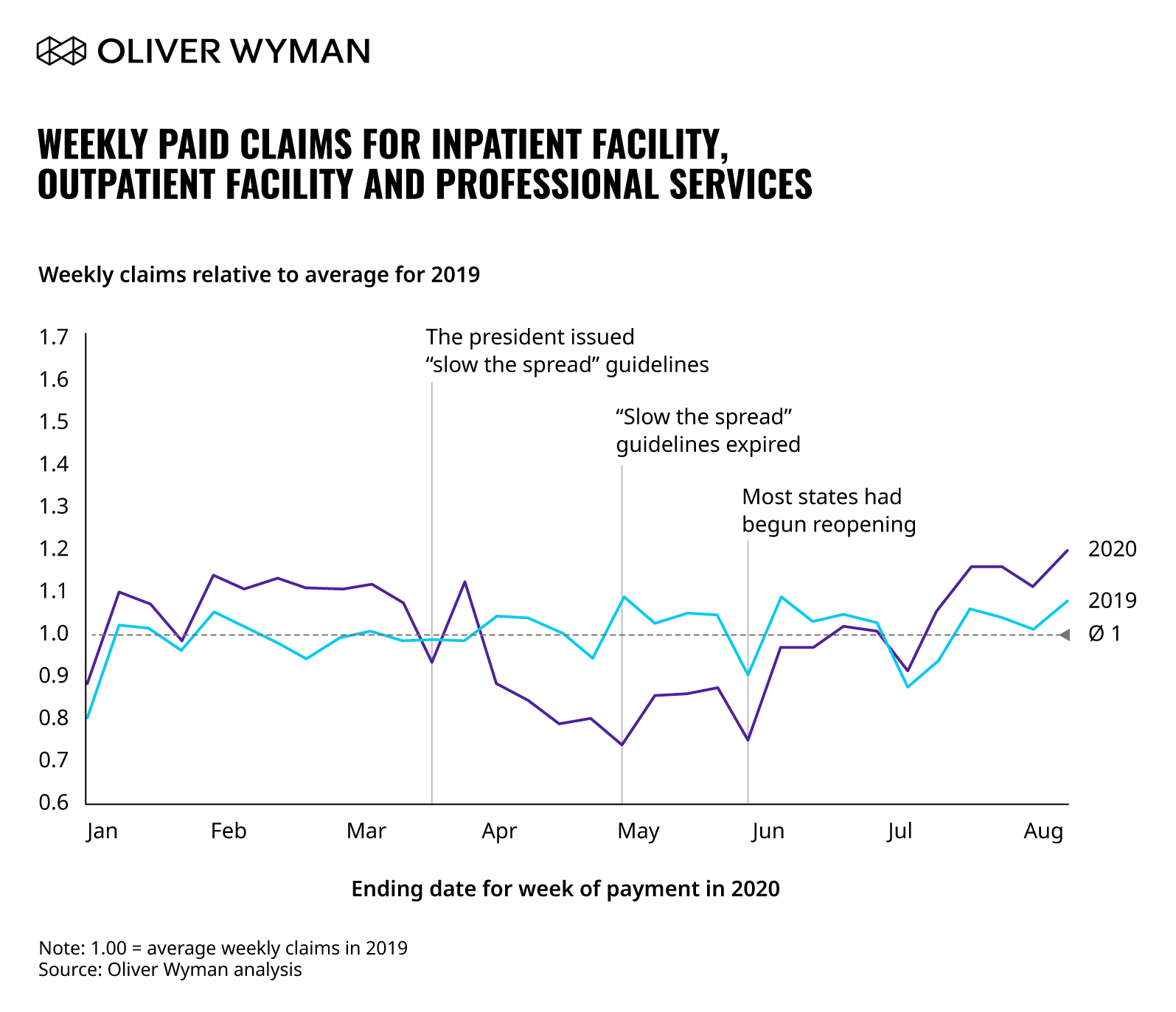

We have been given access to a dataset of healthcare claims from a large, nationwide employer. This employer has employees in every geographic region and a stable workforce with limited exposure to layoffs and furloughs that have occurred to date. In the chart below, we show this employer’s weekly paid medical claims for both the first 32 weeks of 2019 and the first 32 weeks of 2020, all relative to the average weekly paid claims in 2019. (Note the first week in our data for 2019 runs from December 31, 2018 through January 6, 2019. The first week in our data for 2020 runs from December 30, 2019 through January 5, 2020. The remaining 31 weeks follow accordingly. While this employer covers prescription drugs, we have excluded them from this analysis as paid claims for prescription drugs were not impacted to the same degree as medical claims.)

Note that there is a lag between the time services are provided and claims are paid. That lag will vary by type of service, and by issuer (some issuers pay a larger share of claims based on electronic edits, and therefore more quickly, than others).

Between the week ending January 5, 2020 (week 1 of 2020 in our data) and the week ending March 22 (week 12), weekly paid claims in 2020 were eight percent higher than weekly paid claims in the first 12 weeks of 2019.

On Monday, March 16, the president issued a set of guidelines that Americans were to follow for 15 days to “slow the spread.” The president later extended those guidelines for another 30 days to expire on April 30. As the chart shows, and keeping in mind the lag between when a service is provided and the claim is paid, the impact of these guidelines on paid claims was rapid and negative. Between the week ending March 29, and the week ending May 31, weekly paid claims in 2020 were 16 percent below weekly claims for the same period in 2019, reflecting the impact of deferred and foregone care following the shutdown.

With the president’s guidelines expiring on April 30, three states, Georgia, Oklahoma, and Alaska, began reopening, allowing some personal care businesses, dine-in restaurants and theaters to reopen. The reopening was gradual, but by the middle to end of May, most states had begun to reopen. From the week ending June 14 through the week ending August 9 (week 32), the most recent week of detailed data we have available, paid claims in 2020 were six percent above claims for 2019. Our hypothesis is that this reflects the beginning of the return of care that had been delayed. If the pattern in paid claims since the week ended June 28 were to persist for the balance of the year, paid claims for all of 2020 would be roughly four percent higher than paid claims for all of 2019.

It is possible that paid claims will be suppressed in the second half of 2020 in parts of the country experiencing increasing cases of COVID-19. At the same time, the cost of treating new COVID-19 patients coupled with the return of care that had been delayed could push paid claims higher than those observed in the data since states began reopening. Health plans, providers, regulators, and policymakers will be keeping a close eye on how these and other COVID-19 factors impact medical claims.