Editor’s Note: The following article is part of an ongoing series offering our strategic advice and expertise on what healthcare industry stakeholders should do immediately in response to the rapidly evolving novel coronavirus (COVID-19) pandemic.

At least one in seven working Americans is now unemployed. And as high as one in four Americans is unemployed or underemployed. This rapid economic shift has upended our country’s health insurance mix. As an immediate result, more Americans are rapidly losing their employer-sponsored healthcare coverage, with many now unable to afford their Affordable Care Act (ACA) plans’ high premiums.

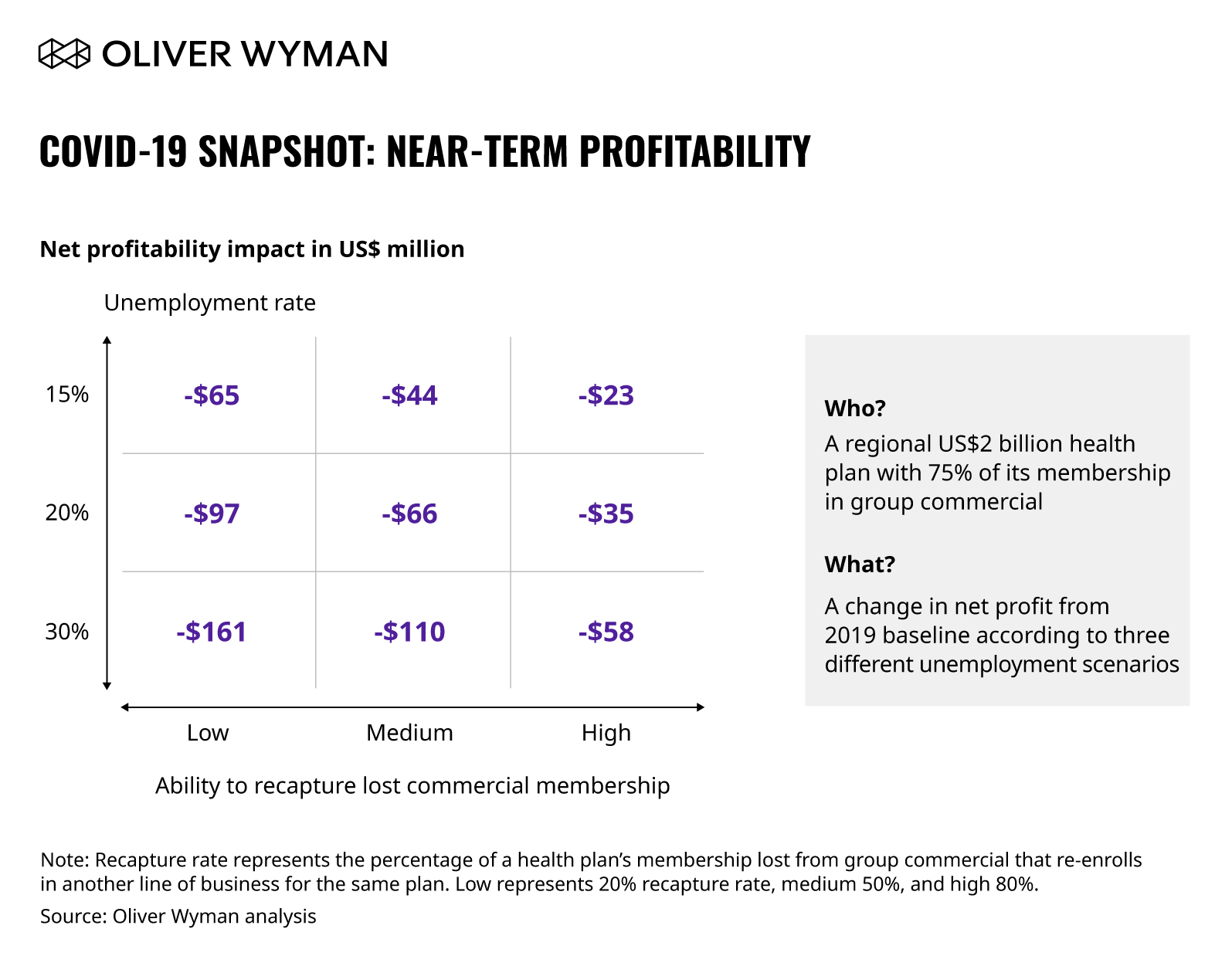

The group commercial category will experience the biggest membership losses, according to various scenarios Oliver Wyman has run. The biggest drivers include direct loss of employment (and therefore direct loss of healthcare benefits) and pullbacks in healthcare benefits from employers. For example, at 15 percent unemployment, the group commercial segment will lose 17 million lives to the Medicare, Medicaid, individual, and uninsured segments.

Which Health Plans are Most Exposed to the Membership Shift?

Health plans nationwide can be mapped on a spectrum of portfolio choices from deep specialization to multi-line diversified businesses. Across this spectrum, those health plans with a high dependence on commercial membership will likely see the most immediate and biggest impact on membership, cash flow, and profitability. Even those employers who would like to continue offering healthcare benefits may be unable to afford the existing premiums given current economic conditions. Those health plans with a balanced portfolio will see material degradation in membership and margins. Each line of business is expected to see some margin erosion independent of membership movements.

Understanding the level of impact this mix shift will have on your health plan depends on several factors. Smaller plans may find it harder to manage large membership shocks. Plans with predominantly commercial businesses will see rapid membership erosion. Plans with high membership concentration in COVID-19 “hot spots” will face disproportionate membership losses.

As we highlight below, consider that a “typical” $2 billion health plan with three-quarters of its membership in group commercial will see a $65 million hit to profitability. And, they will have company: over 250 plans nationwide are at high risk for dramatic impacts on profitability.

Don’t Leave Millions Upon Millions on the Table

Many plan executives are already thinking about significant cost actions to ensure a bright future for their businesses. Fortunately, there’s an ample opportunity to take out administrative costs and optimize the medical management function to better manage medical costs in most small and mid-sized health plans.

Over weeks (not months), a top-down assessment of administrative functions can identify between 10 and 20 percent of administrative costs that can be removed between 12 and 24 months. Interestingly, typically between 5 to 10 percent savings are front-loaded in the first four to six months (“quick wins”), helping sustain longer-term cost takeout initiatives.

Cost takeout does not come from one action. To drive a successful, comprehensive transformation, multiple levers must be simultaneously addressed to ensure the new operating model is nimbler, more efficient, and set up to drive a sustainable cost base. Plans that unlock these savings can reallocate a portion to invest in two to three strategic differentiators to further strengthen their mark position.

As an example, a regional health plan with $290 million of addressable administrative spend identified over $63 million in administrative cost savings. They specifically identified $14 million in the front office by optimizing marketing spend across channels, by looking at channel effectiveness and saturation while realigning sales organization to focus on mission-critical “sales” activities, and by moving a large set of administrative duties to the back office. This plan also identified over $12 million in savings (achieved within eight months) through strategic sourcing by systematically reviewing, analyzing, and optimizing vendor contracts, pricing, and service-level agreements.

Cost Takeout for Financial Institutions

For inspiration of what’s working well regarding cost transformation efforts amidst the pandemic, perhaps look beyond healthcare. Financial institutions’ cost transformation, for instance, can greatly inspire health plans to do the same. In the following out-of-industry case study, for instance, Oliver Wyman worked with the markets group at a global investment bank to achieve an ambitious near-term cost savings target of 10 to 12 percent of its technology and operational cost using a structured cost takeout approach.

Here were five strategies:

- Created transparency into existing cost baseline, including establishing an activity-based view of services (and the costs and resources tied to these services). A big finding here was a high variance between allocations and true activity-based costs leading to ineffective management decisions.

- Compared cost performance against industry and out-of-industry benchmarks to flag areas for further investigation. While there were meaningful justifications for certain discrepancies, others pointed to clear system waste.

- Assessed near-term efficiency levers (such as vendor consolidation, volume pricing, and shift to cost-flexible workload driven technologies) and drew from Oliver Wyman’s cost actions database to identify “quick wins” – actions that required a low effort but yielded meaningful savings.

- Developed a roadmap to implement “quick wins” first and leveraged savings from these quick wins to implement longer-term processes and technology initiatives.

- Redesigned the operating model and ensured cost savings were not eroded by developing tailored leading cost indicators to actively monitor cost trends and take rapid corrective actions.

When and How Do I Start the Same Kind of Journey?

Cost transformation is often feared and avoided by many organizations and executives. But when done thoughtfully, it unlocks savings that can boost investments in true differentiators for the company.

The COVID-19 crisis has led to an immediate opportunity for plans to act now to meaningfully reset their cost baselines. The right way for most plans will be to validate their “North Star” strategy, drive a rapid cost and operating model review, and launch cost transformation actions to both meaningfully reduce system waste and reinvest in select differentiators.