Healthcare has historically had well-defined industry roles, with discrete organizations focusing on research and development (biopharma), financing (governments, insurance carriers, employers), care delivery (hospitals, physicians, pharmacies), enablement (technology companies), and regulation (governments again). New consumer needs, evolving science and technology, and political economic forces are disrupting this paradigm, thereby ending the role of “the middleman” in healthcare.

In response, players across and outside the industry are developing new business models and beginning to play new roles in the healthcare ecosystem. As companies evaluate how they will succeed in this new ecosystem, it will be tempting to rely on known recipes for success. To win, organizations must reevaluate how they run their businesses as they transform into new roles – without being fooled by common missteps.

In mature healthcare markets like the US, this means actively resisting the status quo, but also not just doing the opposite (which, too often, is the instinct of executive teams who want to “disrupt” their own organizations). In growth markets like Asia, healthcare leaders have the opportunity to build businesses the right way from the ground up, learning from the mistakes of their Western counterparts.

Here are Seven Lessons Healthcare Organizations Must Learn to Achieve Real Impact:

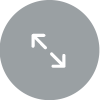

Healthcare organizations have relied on numerous, capital-intensive assets for service delivery (for example, thousand-bed hospitals and mainframe claims systems). With a proliferation of virtual care, automation, and cloud-based solutions, many organizations risk falling into the trap of moving “all digital”, building technology solutions that are too far in advance of their customer base and operations. Instead, it will be critical for organizations to be asset agile, investing in facilities, equipment, and technology that can be adapted as business needs change. For example, when Sutter Health launched its Walk-in Care clinics, they specifically looked to sign flexible leases and built a rapidly-installed practice prototype, so they can quickly open and move clinics as needed to meet changing consumer demands.

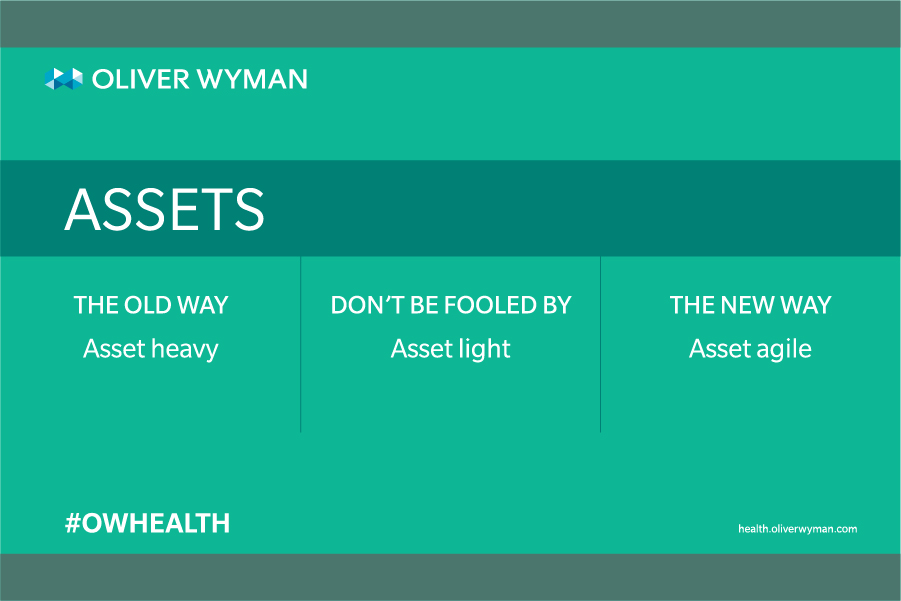

Most consumers seek care in their communities, and geography-specific regulations have created barriers to fully global solutions. As technology begins to break down barriers, it’s easy to start envisioning a world where global scale players emerge across parts of the industry that haven’t experienced this type of consolidation previously. Hospital operations are a great example: although many US-based hospital operators (including the University of Pittsburgh Medical Center, ProMedica, and Cleveland Clinic) have partnered to develop facilities in China, they've struggled to adapt to how physician and patient expectations differ from other markets. To make the most of scale opportunities, organizations must enable local leadership teams to respond to local market factors.

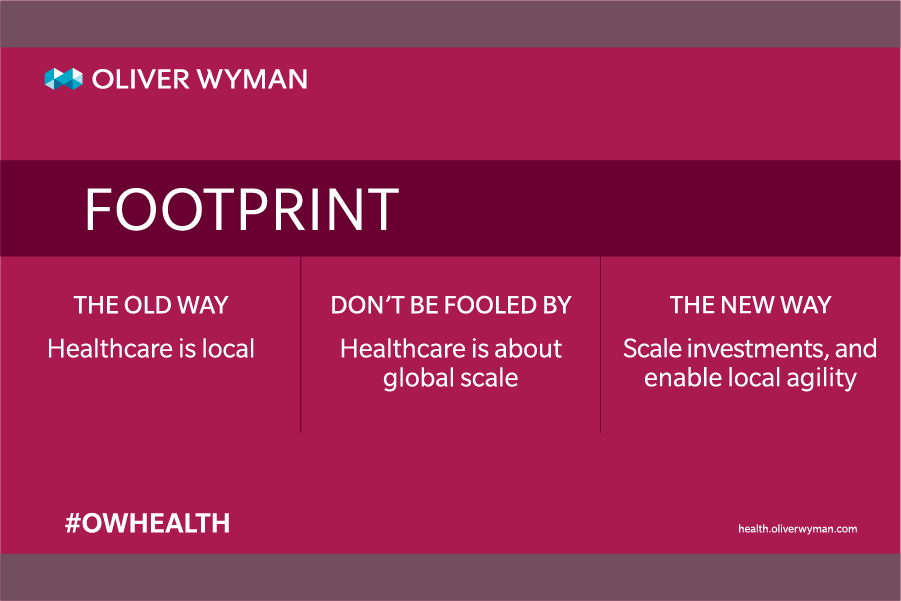

In an ecosystem with clearly defined roles, it was easy – and in fact, important – to do as much as you could yourself. As the lines between industries blur, incumbents will increasingly need to acquire capabilities from organizations they’ve traditionally treated as vendors or competitors. In response, many will pursue joint ventures in the hopes that the combined entity will represent a faster, nimbler alternative to building capabilities in-house. Instead, organizations should develop partnerships as a core competency, and use a variety of different models to launch new and differentiated products. This will require companies to not only invest differently in business development and legal, but also marketing, distribution, operations, product, and technology teams that can co-develop and co-deliver services in a way that feels seamless for customers.

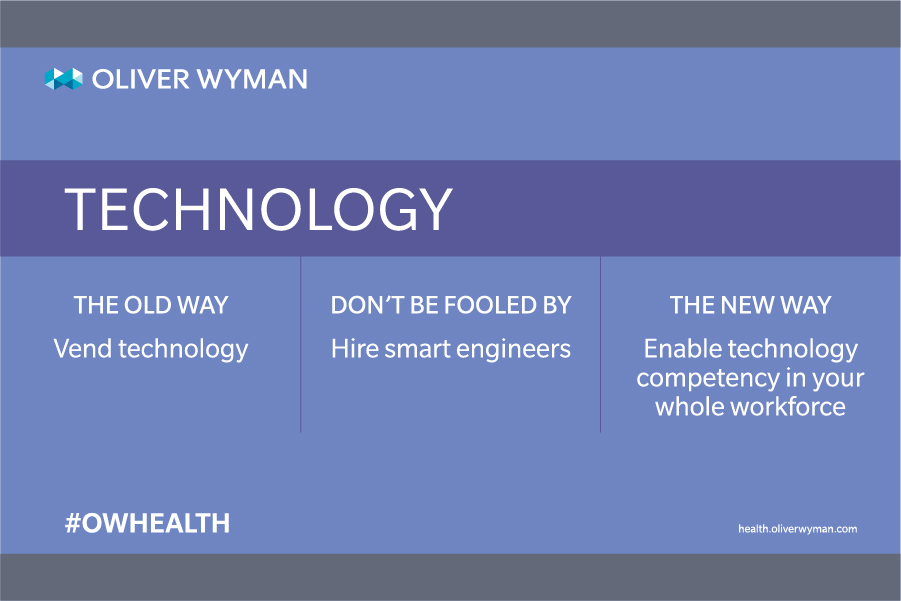

Most healthcare companies have viewed technology as an enabler and have spent billions of dollars on vended solutions such as Epic, Salesforce, and Facets. As technology becomes not just a differentiator but a core part of the service offering, many have responded by hiring smart engineers from the likes of Google, Microsoft, and Facebook, and asking them to develop technology solutions in silos, with insufficient scale to transform the business. Instead, successful companies will enable technology competency across the whole workforce. For example, when American Express wanted to improve the efficiency and accuracy of their operations using Artificial Intelligence (AI), they ran all of their senior executives through a comprehensive training program – including the Chief Executive Officer – on how to apply AI to real business problems.

As much as companies have invested in technology, healthcare remains very much a labor business – which is both costly and risky given projected shortfalls in the healthcare workforce. Advances in AI and robotic process automation have the potential to reduce healthcare’s reliance on human labor. For example, healthcare AI company, Olive, can with only a username and virtual private network (VPN) connection, automate many low-complexity tasks in revenue cycle and billing within the first month of installation. Successful organizations will be quick to take advantage of AI and automation, but they will also recognize these technologies can’t do it all. Many of these technologies will only replace portions of existing jobs. These companies will deploy AI and related solutions to help their workers focus on more complex problems, versus replacing jobs wholesale.

The healthcare workforce is not just large, it's highly skilled. As an industry, healthcare has generally favored expertise over emotional intelligence (EQ), and credentials over empathy. Given this, it’s no surprise healthcare organizations routinely fall to the bottom of customer satisfaction and net promoter surveys. With more healthcare solutions entering the market, it will no longer be enough to compete on access and quality; customers will also make decisions based on experience. To address the experience gap, some organizations have tried to overlay empathetic front-office staff on top of existing talent and processes with limited results. Customers still eventually interact with an unfriendly system, and front-office staff are insufficiently informed or empowered to really address customer concerns. To truly be successful, companies must expect everyone on their teams to be empathetic, and scale expertise in solving customer problems across their teams.

Customers make many of their health decisions based on relationships – from choosing the doctor they’ve known since childhood or the health plan recommended by a close friend, to the expensive procedure or drug prescribed by their physician. Healthcare organizations have recognized this and have gone to great lengths to own the customer through designing products – and influencing regulations – that keep customers in their ecosystems. With customers having more and more information at their fingertips – Google receives more than 1 billion health questions every day – it's clear having access to individuals’ health and consumption data will be critical to influencing behavior. However, owning the data alone is insufficient. Companies must use this data to earn customer trust again and again. And with emerging competitive moves by companies like Amazon, Apple, and Google, it's clear the bar for consumer trust will be very high.