In the US, we generally view medical care and health insurance as expensive. Imagine a family of four from Corpus Christi, Texas: two 50-year old adults (who are employed, but were not offered employer-coverage) and their two children. They have an annual household income of $100,651 – or 401 percent of the federal poverty level (FPL). What does this family do for health insurance? Well, if they wanted to purchase comprehensive major medical coverage, the lowest-cost silver plan available to them on the Exchange would cost $22,961 – nearly a quarter of their income – and the plan they would be purchasing would have a $5,200 per-person deductible (including a family deductible of $10,400). According to Oliver Wyman analysis, the lowest-cost silver plan in Corpus Christi is actually less than the median of lowest-cost silver plans available in the states using the federal Exchange.

The Very High Cost of Coverage, but Only for Some

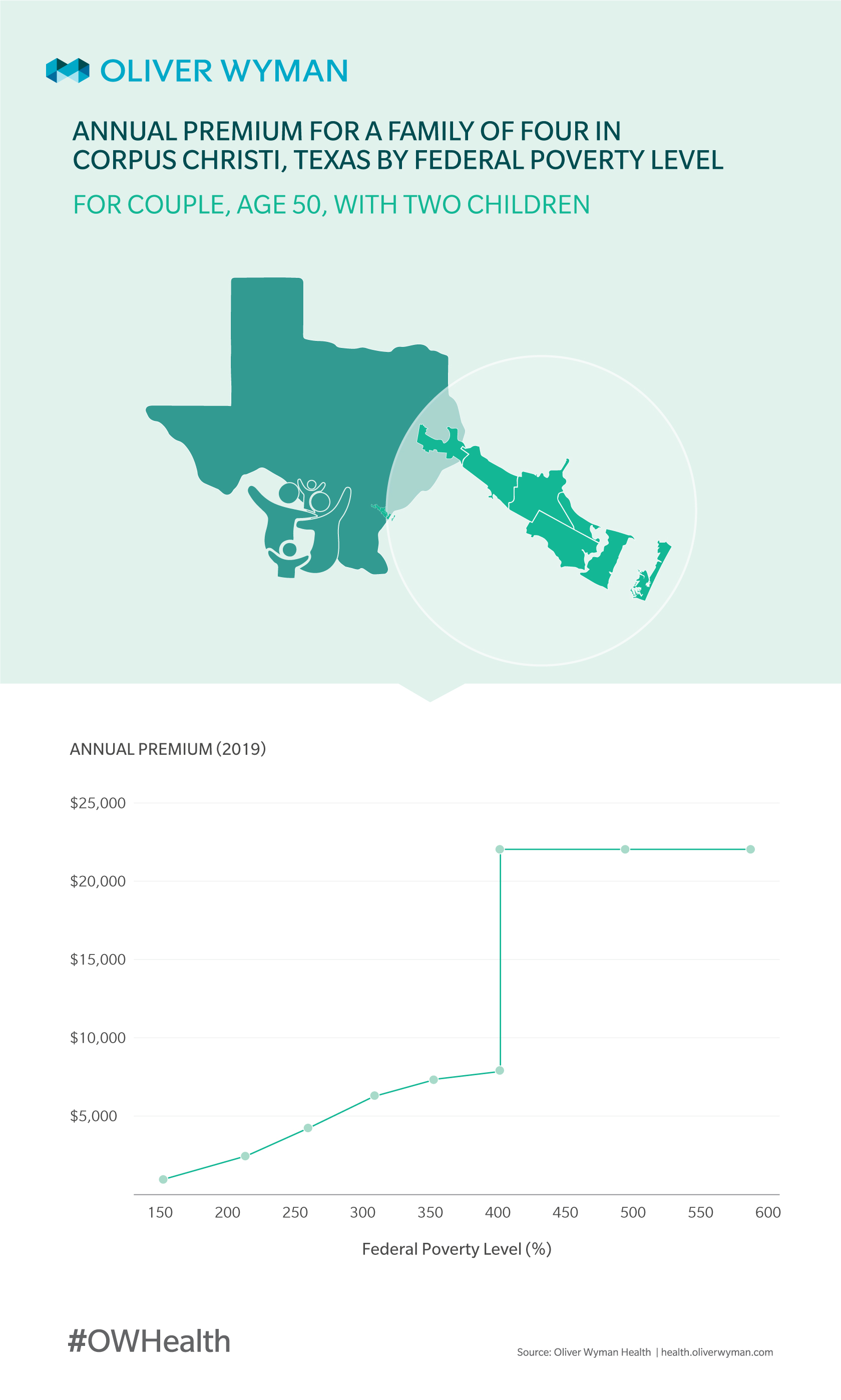

To help healthcare consumers afford the cost of coverage, the Affordable Care Act (ACA) includes premium subsidies for individuals with incomes from 100 percent to 400 percent of FPL. Chart 1 shows what our hypothetical Corpus Christi family’s premium for the lowest-cost silver plan would look like after premium subsidies as income ranges from 150 percent of FPL to 600 percent of FPL.

At 150 percent of FPL, this family could obtain coverage for the lowest-cost silver plan for free due to premium subsidies and the difference between the lowest-cost and the second-lowest-cost plans. At 400 percent of FPL, their premium after subsidies would be $8,244. At 401 percent of FPL – the point at which a family is no longer eligible for premium subsidies – their premium would spike to $22,961. Of course, people with access to employer-sponsored coverage purchase that coverage with pre-tax income and therefore receive a subsidy equal to the income taxes are not required to pay on that income.

Healthcare Reform’s Ripple Effect

One of the reasons ACA market coverage is so expensive is also one of the law’s most popular provisions – anyone can enroll in coverage during the open enrollment period, regardless of their need for healthcare services. And, the premium rate they pay cannot reflect their expected need for healthcare services. The result of this guaranteed access? According to Oliver Wyman calculations, the illness burden in the individual market is roughly 23 percent higher than for the small group market. As we noted in a prior Oliver Wyman Health article several years back, this cost falls primarily on individuals and families with incomes above 400 percent of FPL. The premium subsidies largely protect those with lower incomes from this cost. Therefore, it’s no surprise individuals and families who don’t qualify for premium subsides have been leaving the market.

Policymakers do have a proven mechanism for addressing the affordability issue in this market – reinsurance programs. Basically, reinsurance helps pay for very high claims, reducing insurers’ overall expected claims costs and the premiums they charge for coverage – ameliorating the impact of guaranteed access we discuss above. The ACA introduced a temporary nationwide reinsurance program for the first three years after the law went into effect. Since then, these reinsurance programs have been state-sponsored. Alaska addressed the affordability issue with a reinsurance program: In 2017, the 40 percent proposed rate increase in Alaska fell to a seven percent rate increase; 2018 saw a 26 percent rate decrease. Other states have had similar success.

What Can be Done about Affordability? Here are Oliver Wyman’s Estimates

We used our microsimulation model to understand what could be accomplished using a federally funded, state managed reinsurance program with a $5 billion net cost in 2021. We estimate that such a program would reduce nationwide average premiums by almost 30 percent, and because coverage would be more affordable, it would draw another 2 million people into the market, almost all of whom would not be eligible for premium subsidies. Because this program would lower premiums for both the subsidy- and non-subsidy-eligible population by almost 30 percent, and because premium reductions for the subsidy-eligible population reduce federal outlays for premium subsidies, the size of the reinsurance program that could be provided for a net cost of $5 billion, is considerably larger than $5 billion. We estimate a federally funded reinsurance program using Section 1332 waiver authority could provide around $25 billion in reinsurance for a net cost of $5 billion, with the other $20 billion going to reduce federal outlays for premium subsidies.

A few caveats are in order here. Our modeling assumes the $5 billion is apportioned among states where premiums decrease by the same amount in every state. Insurers setting their premiums according to expectations of a reinsurance program’s effects may view the impact differently than we do. Although we have not modeled the impact of this $5 billion reinsurance program on the group market, we believe this program would not have material impact on that market. Finally, our model doesn’t anticipate major changes to the operation of the health insurance markets beyond the reinsurance program.