Editor’s Note: This is the final part of a trifold “Hospital of the Future” series. in part 1, we explored the top strategic pursuits the vast majority of health systems are advancing today. In part 2, we highlighted examples of innovation driving new services and operating models. In this third and final installment, we explore the long-term future of hospital-based health systems and what kinds of models will differentiate and thrive over the next decade.

Trying to Evolve

Although there are over 5,000 hospitals in the US, there are far fewer hospital-based health systems – a product of significant industry consolidation. Most of the approximately 200 systems with over $1 billion in revenue are competing on similar terms to establish themselves as Deep Market Leaders — creating "must have," high-quality physician networks across a broad spectrum of clinical services with local density and a strong brand. The need to fortify this position amidst a challenging economic climate has driven systems to pursue remarkably similar near-term strategies.

As long as healthcare remains an employer-based model versus a marketplace (a la Amazon), select systems will succeed as Deep Market Leaders — creating value across any local insurance product or network. They will continue to boast an "everything to everyone" approach and will seek to expand their footprint by running a hub-and-spoke strategy with bigger geographic catchments or become more distributed community health systems (for example, a satellite model with a heavy ambulatory focus). The healthcare equivalent of a local sports team, stressing their legacy and hometown cred.

But the real estate for growth, let alone economic sustainability, will leave many hospital systems in a precarious position if they all aim for the same North Star. What will happen to the rest of the field? Are we seeing the early signs of Sears – with high fixed cost assets with generic and undifferentiated offerings surrounded by new classes of organizations – chipping away at their value chain? Or are there ways for hospital systems to evolve, potentially with fundamentally different roles than today?

Looking Ahead – Future Hospital System Archetypes

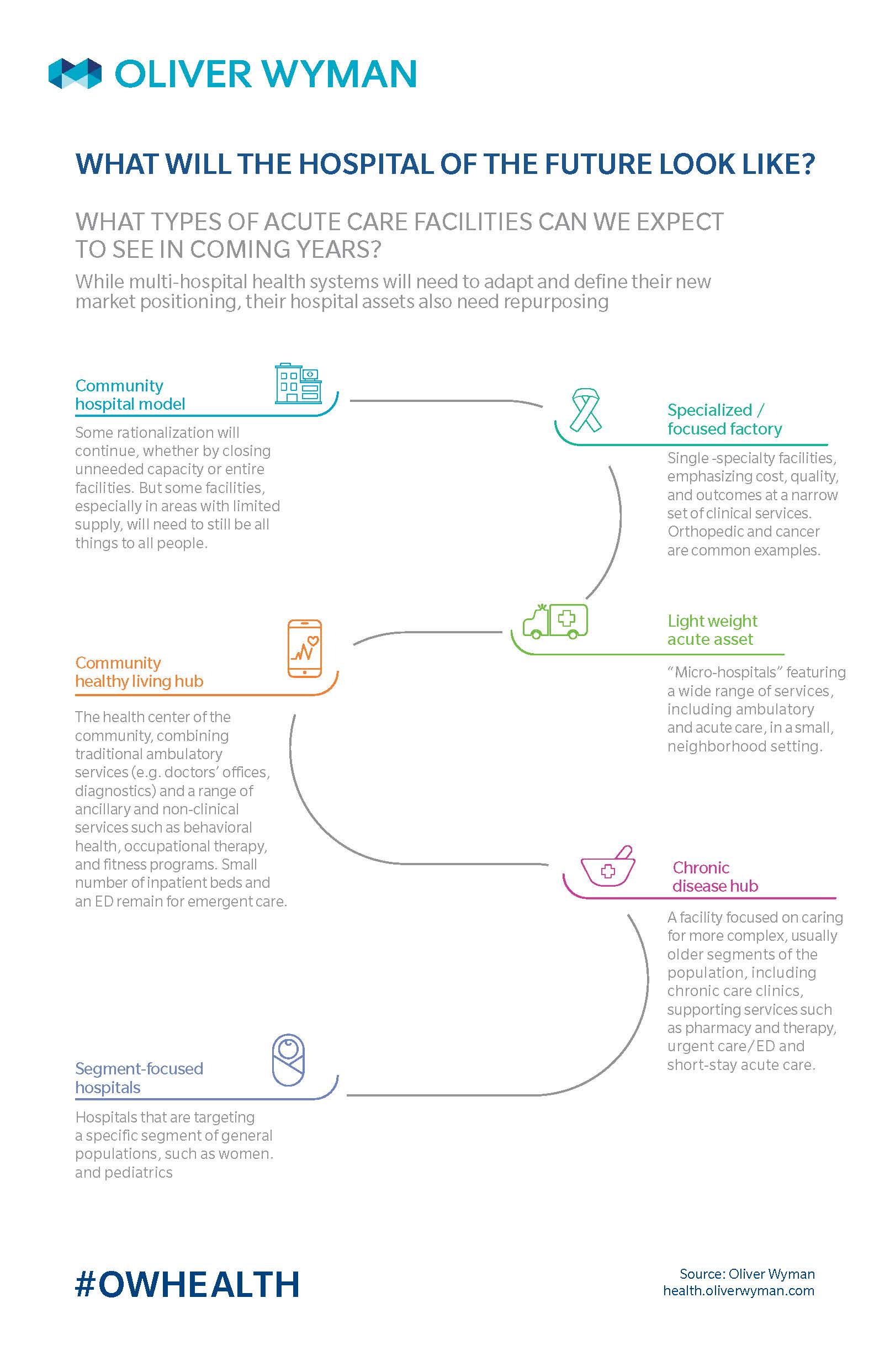

As we peer over the horizon, a few immutable trends inform the future of hospital systems. First, cost is untenable, requiring a whole new thinking of the operating model and cost structure. For most, being everything to everyone, everywhere, is not sustainable. Second, inpatient utilization continues to drop – acute care assets are increasingly becoming fixed cost "albatrosses." Third, clinical innovation requires increasingly larger investments and computing power, artificial intelligence, and genomics capabilities. Fourth, value-based payment and value-based care is a slow building wave that will be hard to reverse. Fifth, retail and convenient care is moving upstream into diagnostics and chronic care. Lastly, technology as a whole, and "big tech" specifically, will begin to enable a different patient / member / consumer relationship model.

Against this backdrop, hospital systems willing to rethink traditional parameters – such as scope of services, scale, areas of innovation, and business and operating models – will find several alternate paths hold great promise. These archetypes have different sources of strategic control and fulfill different, vital market roles. While organizations may be able to blend the archetypes, they each require a level of focused excellence. Here are six future state health system models to consider:

1. The Scale & Efficiency Leader

The Scale & Efficiency Leader will create affordable regional and national health solutions, using an innovative operating model. This archetype will transform the traditional cost structure by leveraging technology, upending the labor model and use a flexible assets management ownership. Under this cost structure, scale matters and unlike today, bigger will mean cheaper.

Key characteristics:

- Fundamentally transforms the fixed versus variable cost dynamics, so scale becomes crucial

- Leverages technology to upend traditional labor costs in back-office (such as automation) and front-line (such as artificial intelligence)

- Creates a highly flexible cost structure through different fixed assets ownership and talent employment models

- Expert at rapidly moving in and out of geos and updating local services mix based on the changing landscape

How do you win?

- Highly standardized and efficient operations enabling low-cost proposition (passed through to customers)

- Replicable model across markets – with a multi-region footprint to take advantage of scaling economies

- Become the preferred (acute) partner for plan sponsors and independent physician groups

Non-healthcare examples

- Walmart

- Costco

2. The Experience & Access Leader

Re-inventing patient engagement, the Experience & Access Leader will offer a personalized health experience to meet unique patient needs. This role will leverage new digital capabilities to proactively engage patients and serve them on their terms. It will offer a range of access options (virtual, convenient, and traditional), integrated across modalities and with the rest of the care continuum.

Key characteristics:

- Best-in-class digital engagement capabilities

- An integrated multi-modal front end of care

- Great access, at various price points and modalities

- Tailored, easy to use service model with a much higher touch experience

- Knows its patients / customers best and caters offerings to them

How do you win?

- Best-in-class Net Promotor with extraordinary loyalty (win at the consumer level)

- De-averaged offerings – build holistic solutions around segments that matter

- Consumer data assets beyond the electronic health record with seamless integration across consumer touchpoints

- Ability to operate with retail-like assets and pricing

Non-healthcare examples:

- USAA

- Delta

- Starwood

- Starbucks

3. The Portfolio Manager

Moving away from the generalist model, Portfolio Managers will manage a set of care "brands" catering to a specific clinical need (such as cancer) or a sub-population (such as pediatrics). They will repurpose and deploy their assets across large markets, aiming to create competitive advantage in cost, outcomes, and experience versus the average community hospital.

Key characteristics:

- Move away from every hospital being a full-service model and pivoting to highly focused destinations of care with a navigated end-to-end experience

- Convert / build episodic and disease centers (such as orthopedic and spine hospitals, short-stay procedural facilities, and neurologic institutes)

- Invest in population-driven campuses – for instance, women and seniors

- Apply a homogenous staffing approach to these assets to improve quality and throughput (more focus means more repetition)

- May maintain a small number of hospitals as general community assets

How do you win?

- Relentless focus on areas where the organization can excel

- A portfolio of targeted / segmented offers

- Ability to attract patients from larger distances to its destinations of care

- Deliver consistent, great outcomes at a low cost

- Partner with plan sponsors for episodic care (such as bundles)

- Market to consumers who can pick an in-network provider (preferred provider organization)

Non-healthcare examples:

- Procter & Gamble

- Unilever

4. The Clinical Leader

As the race for clinical innovation intensifies, the Clinical Leader will be able to develop and monetize innovative treatments, technologies, and training to advance the practice of medicine. It will then "productize" and franchise its innovations, creating a strong provider-to-provider business by leveraging its brand and care models, ultimately creating global patient catchments.

Key characteristics:

- Clinical research and innovation-led organization

- Leader in application of precision / personalized medicine

- Focuses on tertiary / quaternary care, divests "bread and butter" care volume to focus on clinical innovation

- Supports a global provider partnership model to establish broad patient catchment area

- Owns a superior brand, highly recognizable nationally with only a small number of comparable organizations nationally

How do you win?

- Be far and beyond the strongest brand in a narrow clinical specialty

- Charge a significant premium for services

- Productize and spread clinical expertise by using technology and data integration

- Have a diversified business model – with patient revenue becoming a much smaller part of overall portfolio (with a bigger part coming from business-to-business services and patented solutions)

Non-healthcare examples:

- Tesla

- Apple

- Sonos

5. The Population Health Manager

The Population Health Manager is an integrated delivery network solely focused on owning and managing risk for total cost of care outcomes. It will support a range of disease-specific and population-specific care models, operating at a large scale and driven by long-term cost of care outcomes.

Key characteristics:

- Integrated care delivery and coverage products (such as payers and providers), owning risk around total cost of care

- Focus operations on value-based care (such as organizational structure or physician compensation)

- Invests heavily in whole community health and social determinants of health

- Relentless focus on moving prevention upstream (much earlier detection of health exacerbations) – with ecosystem partners serving as extenders

- Blends the member and patient experiences to one integrated offering

How do you win?

- Pick geographies with large senior populations and strong Medicare Advantage penetration

- Significant control or influence of the product and benefit stack

- Tailor care models to conditions / populations to drive outcomes

- Willingness to partner with lowest cost / highest quality providers – even if this means diverting patients / volume

- Highly sculpted clinician networks

- Trend and price guarantees

Non-healthcare examples:

- GE, Siemens, shift from sale of capital products to service guarantees

6. The "Non Hospital" System

Finally, perhaps the most removed from today’s model, the "non hospital" system will intentionally divest its acute care assets to focus on ambulatory, digital, and retail offerings. It will promote low-cost, transparent pricing, in an approachable and easy to use format.

Key characteristics:

- Offers full-range of clinical services across the care continuum, except inpatient care

- Selectively contracts with acute care facilities to fill in gaps in offering

- Reinvents the ambulatory care offering

- Innovator in exporting clinical services to the community using technology / asset-light approaches (including specialty care)

How do you win?

- Minimal fixed cost structure

- Competitive, transparent retail pricing

- The ability to serve as the "general contractor" with curated downstream partners

Non-healthcare examples:

- Charles Schwab

- Bonobos

Where We Are and Where We (May) Be Heading

Through this series, we aimed to understand how health systems are reacting to the rising pressures they face. As we have worked with health systems across the country, the default future for most full-service, hospital-centric system is break-even economics over the next five to seven years. We have observed most are using a combination of the same nine tactics, entrenching the current business model and hoping to survive in a zero-sum game with their established and new competitors. We have also seen that while in the minority, some innovative models are beginning to emerge across the country, where providers are angling for new ways to drive differentiation and sustainability. As the healthcare industry converges, it is hard to fathom the four walls of the traditional hospital remaining the center of gravity over the next decade.

Each of the future hospital system archetypes described above hinges on a view that focused excellence will win over generic scale. They rely on fundamentally different ingredients for success (or at least a different mix) – but in their own way, they all contribute to a value-based and consumer-oriented healthcare market. If you are a health system, what bets will you make to create and capture unique value? And if you are another player in the value-chain – whether a payer, retailer, employer, or innovator – what types of hospital systems will you look to partner with to create better consumer propositions? There are still many innovative paths for hospital systems to explore. We are excited to see executives meet the challenge and opportunity head-on.