Editor’s Note: Many healthcare executives, leaders, and influencers are speculating about the impact of major market announcements on healthcare incumbents. Here is a joint Oliver Wyman perspective on how Blue plans can better manage and adapt to ever changing market pressures. Also, many of these views were inspired by the 2018 Blue Cross Blue Shield National Summit in Orlando, an event that two of the above authors, Shari Westerfield and Jim Fields, recently attended.

The Blue Cross and Blue Shield plans, with over 106 million members nationwide – that’s 1 in 3 Americans – hold an influential position in the healthcare industry. The US healthcare market is getting lots of mainstream media attention, as players from outside of healthcare (like Amazon-Berkshire Hathaway-JPMorgan) and players from within healthcare (like CVS-Aetna or Cigna-Express Scripts) announce intentions to shake-up the industry’s status quo. In the meantime, Blue plans seek to better understand how their business models can adapt and thrive amidst numerous emerging health market trends.

Whether these announcements will be the start of meaningful disruption or failed efforts is still to be seen. But the attention these deals attract is a catalyst for Blues to re-evaluate how they deliver value to their customers and how they move forward in a market poised for disruption. Many Blue plans seek answers on how to best manage business model risk and identify new opportunities, as evolving trends continue to influence their strategic priorities, including consumer experience, big data, artificial intelligence, personalized medicine, growth of government, vertical integration, value-based care, and evolving care delivery models.

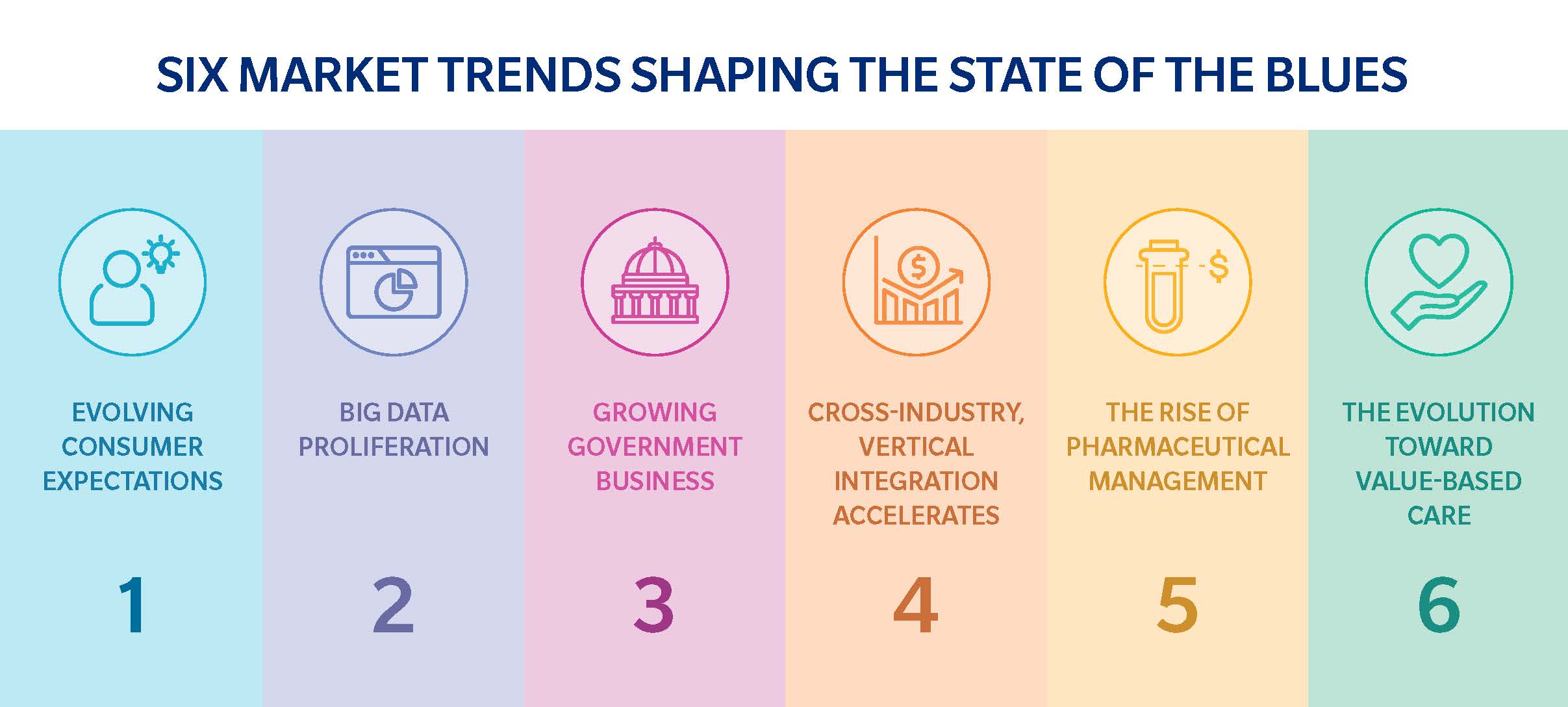

Here are six significant market trends we’ve identified regarding what’s most likely to impact the future state of Blue plans:

1. Evolving Consumer Expectations

The definitions of “healthcare consumer” and “consumer experience” are changing. Improved experience has been slow to materialize, in large part due to the fragmentation of the system — and the fact that so many different players (such as payers, providers, health services companies, and pharmacies) interact with the consumer at different touchpoints. Data silos have prevented technology from bringing greater convenience in healthcare and have led to a proliferation of single purpose apps / tools which digitize but don’t yet enhance the experience. In short, most “consumer solutions” introduced don’t yet solve consumer hassles; they simply reinforce lack of coordination across the system.

Healthcare consumers are often burdened with long wait times, lack of basic coordination of healthcare activities (let alone “care coordination”), and ineffective technologies. Consumers want simplicity, convenience, responsive products, and – even more importantly – responsive people. Blue plans can establish new expectations for how providers (and other healthcare service providers) will serve patients.

What healthcare desperately needs – and what Blues are arguably best positioned to deliver – is a clear set of expectations for “patient first experience standards”. Across many other industries like retail, banking, and airlines, consumer service expectations are becoming more personalized and targeted. Therefore, the Blues should identify and address consumer needs, utilizing systems that combine technology with a multi-channel service experience that turns touchpoints into opportunities for deepening customer relationships.

Blue plans are locally focused and deeply penetrated within their respective geographies, which gives them a more detailed, nuanced understanding of the local community and provider dynamics that help shape a differentiated consumer experience. This gives Blue plans an opportunity to work closely with provider partners on these types of initiatives.

The Blues have unparalleled advantages that position them to reshape consumer experience for the better. Consider what could become possible if Blue plans, often the largest share players in their markets, set basic expectations for each experience members receive from providers. This is standard practice of any industry – and it doesn’t require big investments in technology. To differentiate themselves, Blue plans should do more to see through the eyes of a frustrated consumer to provide a better and brighter way.

2. Big Data Proliferation

As the healthcare industry experiences heightened digitization, new and improved opportunities to make data actionable are emerging. Blue plans have access to unique and deep data that pulls information from across the patient’s care journey, allowing them to shift from data collector to data enabler. Through partnerships and collaborations, Blue plans would be able to better enable providers on insights and successful value based care arrangements, or they could enable their members on how to best utilize those care delivery services available to them.

With large share positions, the Blues have the best visibility into physician practice patterns, allowing them to be better informed on who are the most appropriately practicing doctors, provide consumer reviews, and share health utilization trends, just to scratch the surface. Richer insights come as encounter data is blended with demographic, health status, geo-location, and consumer preference information to increase usability of the system. Blue plans can use this data to shape both decisions from the inside, and outside, like driving new external facing outcomes, improving consumers' lifestyle management choices, or making smarter internal operational and management decisions across plans on a local or national scale.

The Blue plans’ future ability to create efficient yet simple tools will become points of parity, especially as more employers demand high-value, timely care delivery services. The key to success will be Blue plans’ ability to scale their use of data and actionable insights to enable behavior changes in healthcare delivery and consumption.

3. Growing Government Business

Government programs account for more healthcare spend than employer-sponsored healthcare, and continue to grow their share of total healthcare lives. However, most Blues continue to struggle in this area. For example, the Blues’ share of commercial and public-sector insurance from 2016-2017 (according to BLU, The AIS Guide to Blue Cross and Blue Shield Plans-Online) was as follows:

Blue plans are market leaders in the commercial market, but often lag behind the Nationals and specialized players in government markets. Blue plans are reconsidering how well positioned they are in the growing government markets, and several have made the investments to purpose-build capabilities required to succeed in the government markets. But as a whole, the Blue system has failed to find ways to differentiate and drive advantage in government markets like they have in commercial markets.

Those Blue plans that commit to government markets success will acquire talent from Nationals and Specialists with experience in these programs and will provide autonomy to the government business units to operate without the yoke of commercial guardrails.

There are valuable opportunities for Blues in the government programs market. A few examples include leveraging their historic advantages of consumer brand trust, establishing preferred provider relationships that allow them to shape new partnership models and foster strong relationships with State government for Medicaid, and deepen their local presence to build community care models.

4. Cross-Industry, Vertical Integration Accelerates

Merger activity is hot, as more vertical mergers emerge, and non-traditional entrants push new solutions. The healthcare industry will continue to see boundaries being blurred in respect to payer and provider roles. Cross-industry integration, like Amazon-Berkshire Hathaway-JPMorgan and Roche-Flatiron Health, are perhaps merely the beginning.

So will the Blues respond to these kinds of disruptive entrants by taking risks and embracing disruption themselves? There are examples where incumbents in other industries – such as travel, brokerage, and retail – failed due to their inability to embrace disruption. It’s important that Blues understand their core advantages and identify where disruption threatens them, like where they can capitalize on disruption by reinvent parts of the model, even if this entails risk to a current profit center.

The Blue plans, a natural target for disruptors, are in an attractive position to become a disruptive partner alongside vertical mergers and new entrants. In summary, the Blues have a lot of members, respected relationships with purchasers, a strong commercial presence, and high levels of consumer trust. Partnering with innovators is a compelling way for the Blues to potentially leverage their market position to disrupt the healthcare industry for the better and accelerate the rate of market improvement. And this is needed now more than ever.

5. The Rise of Specialty Pharmaceutical and Personalized Medicine

With pharmacy costs now skyrocketing into the double-digits – at a rate that’s drastically outpacing medical costs – more employers are demanding innovative pharmacy solutions to manage high-cost specialty pharmaceuticals and the emergence of personalized medicine.

Blues have few independent pharmacy benefit manager options (not owned by one of their national competitors) for managing the highest growth area of spend. For example, according to the National Health Expenditure Survey, published in Health Affairs by authors associated with the CMS Office of the Actuary, overall pharmaceutical expenditures increased by 24 percent between 2014 and 2016, while overall health expenditures only increased by 16 percent. Similarly, according to 2015 Blue Cross Blue Shield data analysis, pharmacy per-member per-month spend increased by 9.3 percent from 2013 to 2014 – outpacing outpatient (+5.9 percent), inpatient (+1.8 percent), and professional cost (+1.3 percent) growth.

Beyond specialty pharma, the wave of personalized medicine is starting to move from science fiction to early market action. For example, payors are now beginning to explore innovative business models that incentive personalized medicine via appropriate reimbursement in areas such as targeted therapies and molecular diagnostics. And providers are utilizing how a consumer’s genetic profile ties to personalized approaches to disease management, disease treatment, and early detection initiatives. Regarding the next decade of precision medicine, pharmacogenetics apps will be readily available at consumers’ fingertips for tailored drug efficacy and dosing. Underwriting and insurance risk framework rules will be rewritten as government, consumers, and insurers determine how to best use and distribute patients’ personalized genetic profiles.

Precision medicine will also require new social and ethical frameworks. While precision medicine has great potential for some areas of medicine, it also has enormous likelihood of overuse and unnecessary care (pre-emptive medical procedures to address small potential future risks, with little medical evidence to inform the right decisions). A more proactive approach will help the Blues better understand the technologies, choice considerations for consumers, ethical considerations, and will ensure consumers make more informed health choices.

6. The Evolution Toward Value-Based Care

Gradual but steady progression away from fee-for-service toward value-based care presses onward, especially as employers – wanting national value-based networks to curb spending – and government push for better cost control and increased care quality. The strongest performing value-based care plans provide consumers with timely access to care, information to enable appropriate care by providers, aligned incentives, a coordinated product design, and better information and support for members. Blue plans must create value-based care solutions that address growing local and national employer requests. Blue plans have the need and opportunity to develop customizable national networks that deliver low-cost, high quality of care, with a focus on appropriate medicine.

Moving Forward

These are scary times for Blue plans. And, these are exciting times for Blue plans. We advise focusing on leveraging your market advantages to do good for the patient / member to maintain a leading position in the market. The Blues are in a formative period as market trends and disruption create risk for their legacy market position, while also creating remarkable opportunity to leverage their scale, brand position, and positive provider and consumer relationships to be a positive force in promoting constructive disruption and allowing healthcare innovations to improve the market.