Update: 5/4/2017

The House narrowly passed the American Health Care Act (AHCA) on May 4. The bill includes a “Patient and State Stability Fund,” which will transfer $15 billion from the Treasury to the states in each of 2018 and 2019, and then $10 billion per year from 2020 through 2026.

The future of AHCA is not certain, as it now heads to the Senate, where it faces opposition. But should it pass in some form close to its May 4 form, states will play a key role in the future of the individual insurance market. In addition to Patient and State Stability Fund, a late-addition amendment gives states the right to apply to waive certain ACA coverage rules.

Understanding how states might manage high-risk populations will be critical to shaping strategies for 2018 and beyond. Here is a detailed look at the Patient and State Stability Fund.

Key points about the proposed Patient and State Stability Fund include:

- States are given considerable flexibility in how they use the funds

- In order to receive funds, states will have to provide a matching contribution

- For states that do not apply for funds, the Federal Government will establish a default reinsurance program

- The amount each state receives will be based on a formula that takes into account the state’s incurred claims, the number of uninsured, and insurer participation in the individual market

Below are more details about the fund, including an estimation of how much each state would receive. (You can also download the state-by-state breakdown here.)

How states could use the funds

Under the proposed legislation, states are given considerable flexibility in how the funds may be used. For example, the funds may be used for the following purposes:

- Helping high-risk individuals without access to employer-sponsored coverage access coverage in the individual market

- Providing incentives to “appropriate entities” to help a state stabilize premiums in the non-group market

- Reducing the cost of providing health insurance coverage in the individual and small group markets for high-cost individuals

- Promoting participation in the non-group and small-group markets and increasing options available

- Promoting access to preventive services, dental and vision care services, or the prevention, treatment or recovery support for individuals with mental or substance abuse disorders

- Paying healthcare providers

- Assistance to reduce patient cost sharing amounts for things like deductibles

How states receive the funds

In order to receive these funds in 2018, states will have to file an application within 45 days of the law’s enactment; and then for 2019 onward, states will have to file by March 31 of the preceding year. The application must state how the funds will be used and must include a certification that the state will contribute the required percentage (described below) for each of the following years. An application approved in one year will be considered approved for subsequent years.

For states that choose not to apply

If a state chooses not to apply for these funds, the Federal Government will establish a reinsurance program for its non-group market, reimbursing issuers for 75 percent of the amount of an individual’s claims beginning at $50,000 and ending at $350,000. These amounts are subject to adjustment.

How allocation is calculated

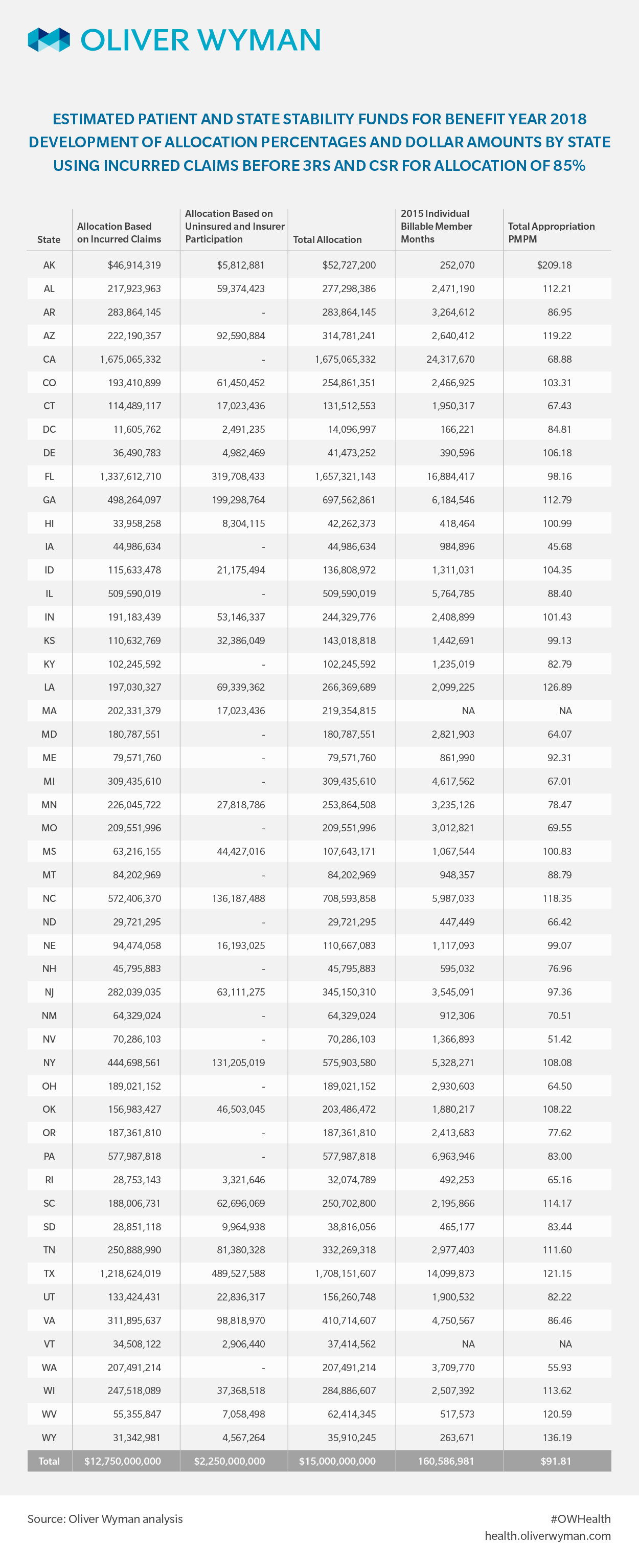

Each state’s allocation for 2018 and 2019 would be based on the determination of an amount related to incurred claims, and an amount related to the number of uninsured and the level of insurer participation in the state.

Eighty-five percent of the amounts appropriated would be allocated based on the total incurred claims in the state, relative to the nation as a whole three years prior. For example, the amount a state would be paid in 2018 would be based on incurred claims in that state in 2015, relative to incurred claims nationwide in 2015.

The proposed bill states that 15 percent of the amounts appropriated would be allocated to states where either the number of uninsured with incomes less than 100 percent of the Federal Poverty Level (FPL) increased between 2013 and 2015, or where there were fewer than three issuers offering ACA non-group coverage in 2017.

In discussions with senior congressional staff, we learned that the intent of the language concerning the uninsured and number of participating insurers is to include in the allocation states whose share of the uninsured with incomes less than 100 percent of FPL decreased by a lower percentage than the nationwide decrease. The estimates we provide here are based on our understanding of this legislative intent.

Using the Current Population Survey data, we estimate the number of uninsured with incomes less than 100 percent of FPL decreased by roughly one-third between 2013 and 2015, and 23 states saw a decrease of less than this. In addition, 18 states had less than three issuers in their non-group ACA market in 2017. Consequently, there are 33 states that would qualify for payments under this provision of the law.

State matching

In order to receive the funds appropriated from 2020 to 2026, states will have to provide a matching contribution. If the state filed an application for funds, the state match will be equal to 7 percent of the state’s allocation of the appropriation in 2020, increasing by seven percentage points each year through 2025, and then by eight percentage points to reach 50 percent in 2026.

If the state chose not to file an application, the match required to receive funds would be higher – 10 percent in 2020, increasing by ten percentage points each year until reaching 50 percent in 2024, and remaining there through 2026.

State-by-state allocation

In the following table, we show our estimate of the 2018 allocation of the Patient and State Stability Fund. Note: We show these funds relative to 2015 billable member months, as published by CMS. While not ideal, we believe that the 2015 billable member months published as part of CMS’s risk adjustment process is the best source available for a denominator to provide context for these funding levels. Download the below table here.